TRANSFER PRICING GUIDELINES MALAYSIA

Transfer pricing 1. In Malaysia the transfer pricing laws and policies are mainly based on the Transfer Pricing Guidelines for Multinational Enterprises Tax Administrations 2010.

How To Choose The Best Printing Companies For Your Needs Printing Center On Patreon Brochure Print Prints Online Printing

It governs the standard and rules based on the arms length principle to be applied on.

. Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations transfer pricing country profiles business profit taxation intangibles In a global economy where multinational enterprises MNEs play a prominent role governments need to ensure that the taxable profits of MNEs are not artificially. Malaysia Income Tax Transfer Pricing Rules 2012 Rule 53 Malaysia Transfer Pricing Guidelines issued on July 2012 Updated version 2017 Chapter III Para 31 According to Malaysian legislation. Under the Income Tax Act 1967 the DGIR is empowered to make adjustments on controlled transactions of goods services or financial assistance based on the arms length principle or.

The local Malaysia transfer pricing TP laws are contained in Section 140A of the Malaysia Income Tax Act 1967 and Malaysia TP Rules 2012. Transfer pricing documentation required in Malaysia are extensive and should include inter alia organizational structure group financial report nature of the businessindustry and market conditions controlled transactions pricing policies selection and application of the transfer pricing method. They govern the standard and rules based on the arms length principle to be applied on transactions between associated persons.

Arms length price Costs Cost x Cost plus mark-up Where. This document replaces the 2003 Transfer Pricing Guidelines. Data and research on transfer pricing eg.

There are three methodologies under the traditional transactional method namely. Repeating low margins or losses Many high value transactions Large deviations in profit and loss histories Reporting a low EBIT compared to the industrys average. Transfer Price refers to intercompany pricing agreements for the transfer of goods services and intangibles between affiliated individuals according to Malaysia Transfer Pricing Guidelines the Guidelines established in 2012.

The traditional transactional method and transactional profit method. The TP rules are applicable to both domestic and overseas transactions between controlled entities for the supply and acquisition of goods or services. According to Paragraph 131 of the MTPG companies falling under certain thresholds mentioned below are required to prepare a comprehensive set of TPD ie.

Generally IRBM applies by the principles prescribed by the Organisation for Economic Co-operation and Development OECD Transfer Pricing Guidelines whereby the tested party is selected based on the least complicated entity and where the transfer pricing method can be most reliably applied should be adopted. In Malaysia taxpayers are required to prepare and maintain contemporaneous transfer pricing documentation annually to prove compliance with the arms length principle. IRB MALAYSIA - TRANSFER PRICING GUIDELINES Formula for adjustment.

Malaysia has introduced country-by-country reporting requirements from 1 January 2017. Malaysian transfer pricing legislation and regulations are based on the arms-length principle in the Organisation for Economic Co-operation and Development OECD Guidelines. The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules 2012.

Although some parts of the Guidelines have been adopted directly from the OECD Transfer Pricing Guidelines there may be areas which differ to ensure. Prepared by the IRBM Multinational Tax Department the Guidelines are intended to help explain administrative requirements pertaining to Section 140A of the Income Tax Act 1967 and the Income Tax Transfer Pricing Rules 2012. The Rules categorise the transfer pricing approaches in two broad categories.

Malaysia applies transfer pricing methodologies following the OECD Guidelines. A MNE runs extra risk of an audit if one of the following situations applies. In an ideal world the transfer price would be the same as the current market value that.

The Malaysian Inland Revenue Board IRB recently updated Paragraph 1123 and 1135 in Chapter XI - Documentation of the Malaysian TP Guidelines as follows. The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules 2012. Taxpayers now have 14 days to submit transfer pricing documentation.

Malaysias transfer pricing law and policy are largely modelled on the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2010 of the Organisation for Economic Co-operation and Development OECD with some variations. This is from the Organization for Economic Co-Operation Development OECD and although based on it there are some variations to the transfer pricing guidelines in Malaysia and some parts. According to the Inland Revenue Boards IRB Transfer Pricing Guidelines 2012 MTPG the extent to which a TPD is to be prepared would depend on a few factors.

The Malaysian Inland Revenue Board updated provisions of the transfer pricing guidelines and with these changes taxpayers now have 14 days instead of 30 days to submit transfer pricing documentation if requested by the tax authority. Introduction to Transfer Pricing in Malaysia. Cost plus mark-up Sales price - Costs Cost Cost plus mark-up must be comparable to mark-ups earned by independent parties performing comparable functions bearing similar risks and using similar assets.

Malaysia also has a TP Guidelines 2012 that explains the TP principles and. 14 days to submit Transfer Pricing TP Documentation We wish to share with you the latest development on TP in Malaysia. Amongst others there are several new provisions found in the Finance Act 2020 that aim to strengthen the enforcement for transfer pricing TP compliance in Malaysia.

Transfer Pricing in Malaysia. The arms length principle is the international standard to determine transfer price and is applicable to all Malaysian taxpayers that entered into a controlled transaction. Recent developments include the introduction of the Income Tax Transfer Pricing Rules 2012 TP Rules 2012 and Income Tax Advance Pricing Arrangement.

1 A person shall apply the traditional transactional methods to determine the arms length price of a controlled transaction. Guidelines are largely based on the governing standard for transfer pricing which is the arms length principle as set out under the Organization for Economic Co-operation and Development OECD Transfer Pricing Guidelines. On another note the Inland Revenue Board IRB has also updated the timeline for furnishing TP Documentation TPD in the Malaysian TP Guidelines MTPG on 29 January 2021.

Transfer pricing guidelines are applicable when at least one party is liable to tax in Malaysia. The comparable uncontrolled price method. Malaysias transfer pricing legislation adopts the arms length principle espoused in the OECD Transfer Pricing Guidelines.

All enquiries may be.

Malaysia Licensed Moneylenders Guidelines For Digital Loan Cash Management Cryptocurrency Cyber Security

Pin By Lieza Ishak On Terengganu Darul Iman Malaysia Malaysia Tourism China Southern Airlines Tourism Department

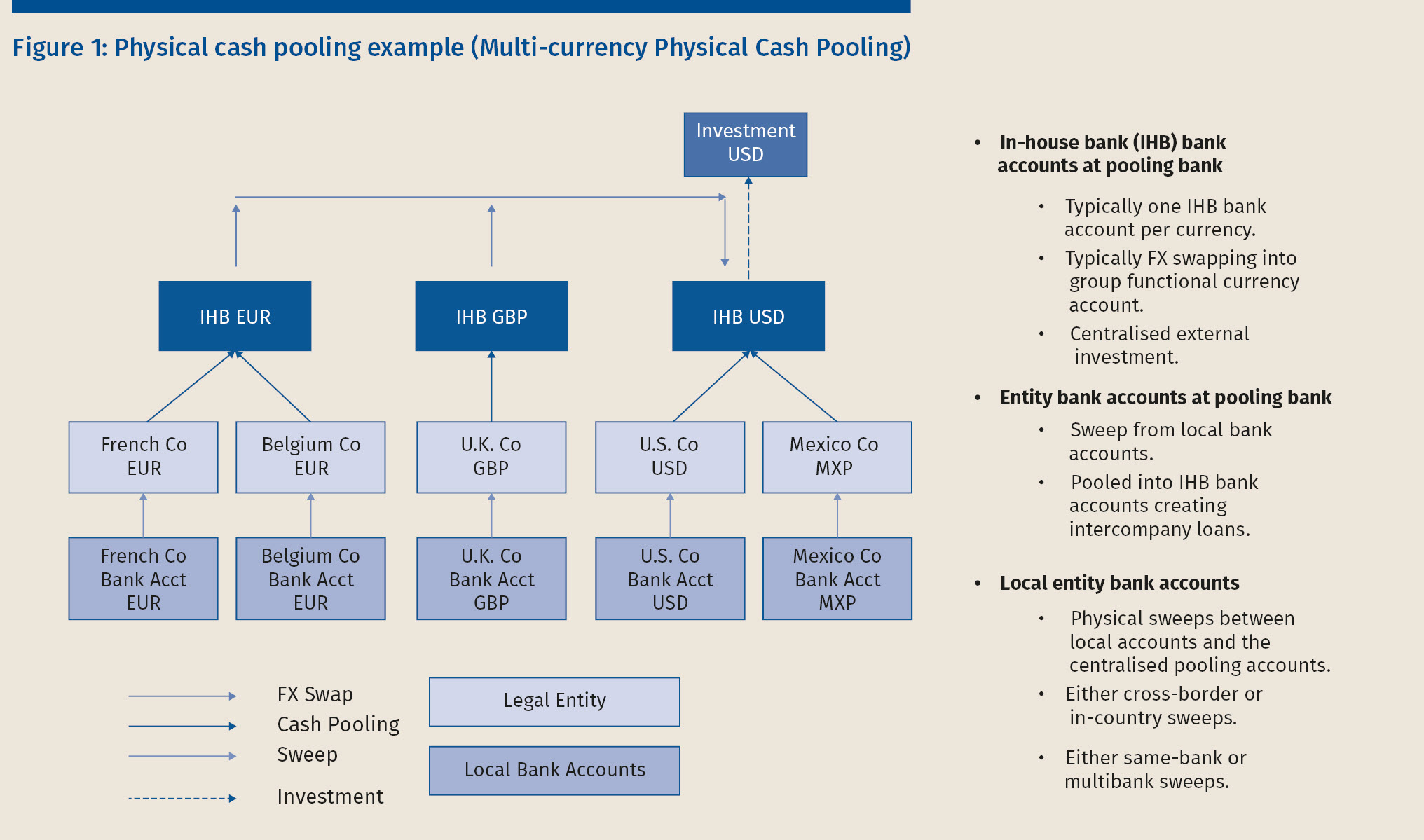

Transfer Pricing Guide To Cash Pooling Arrangements

To Register A Company In Hong Kong Is A Quite Stuffed Process Once You Enrolled To Incorporate A Company In Hong Kong You Business Format Company Kong Company

Food Cross Stitch Pattern Pdf Pattern Colourful Cross Stitch Food Embroidery Pattern Kawai Cross St Colourful Cross Stitch Cross Stitch Cross Stitching

Myhabitat Klcc Malaysia Condo Facade Architecture Design Facade Architecture Condo

Pin On An Intp Exploring The World

Buying Your Home In Malaysia Real Estate Tips Property Investment Tips

0 Response to "TRANSFER PRICING GUIDELINES MALAYSIA"

Post a Comment